Everyone needs a place to live. Whether you decide to rent or buy your home, you need to make sure that you are getting the best value for your money. How do you decide if renting a home is a better deal than buying a home? Let’s take a look at some issues that could factor into your decision.

Can you qualify for a home loan?

If you wanted to buy a house, would you qualify for a mortgage? To qualify for a mortgage, you must be able to put anywhere from 3.5 percent to 20 percent of the home’s purchase price down before the lender agrees to make the loan. Additionally, you need to prove that you make a steady income and have a credit score above 700. For those who don’t meet those requirements, you may have no choice but to rent a home instead.

How long are you staying in the area?

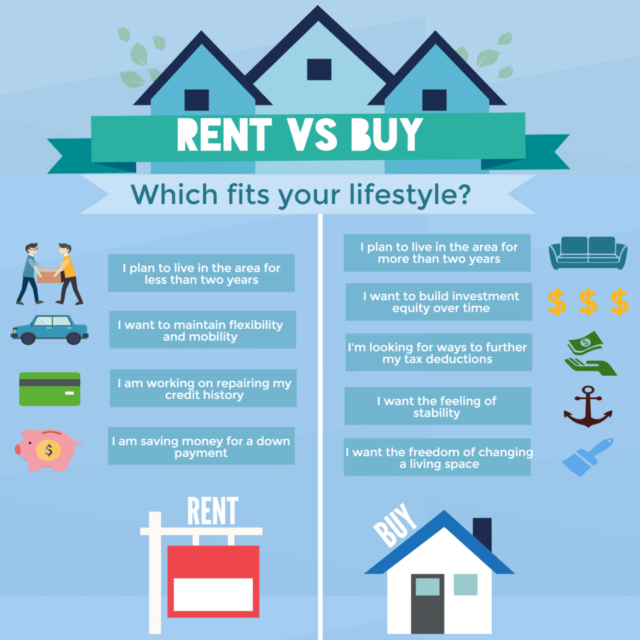

Do you plan on staying where you are for the next several years? Anyone who is in town for a few months or a couple of years on business or otherwise don’t plan on staying put for the long-term may want to rent. With a rental, you only have to stay in one place for a year at most. In some cases, you may be able to negotiate the ability to leave with little more than 30 days notice.

Which is more affordable?

Assuming that you can qualify for a mortgage, is it worth buying instead of renting? When interest rates are low, it may be a good idea to buy instead of rent. This is because more of your mortgage payment is going toward the principal balance each month. Depending on the amount of the house and the interest rate on the loan, your mortgage payment could be significantly lower than what you are paying for rent.

A house is an investment.

A home can be used in a variety of ways to make money for yourself both now and in the future. As you build equity in your home, you can use that equity to secure a loan that can help you consolidate your debt, fund a business or take care of other financial issues as they arise. As home values tend to rise each year, you will see a return on your investment as long as you own your home.

Homeowners get nice tax breaks.

If you itemize your taxes, you could take deductions for interest paid on your mortgage, property taxes and even the amount that you paid in mortgage insurance. If you decide to rent all or part of your home, you can depreciate your property and save money on your taxes there as well.

Should you own a home or rent a home? That is a question that only you can decide for yourself. When you are making that decision, it is important that you think about how long you will stay in the property, how much it costs to rent compared to buying a property and if you can even qualify for a mortgage. Whether you’re buying or renting a home in the Northwest Arkansas area, give Razorback Moving LLC Fayetteville a call for your household furniture moving needs!